If you are looking for your first home or are moving to a new town, the process of buying a home is a process with deadlines. The process is a fairly simple 9-step process.

Before you start, you are going to need to know some information because people are going to ask you for information, and you need to have the answers.

- How much do you make each month/year?

- Gather paycheck stubs

- Gather tax returns

- What are your monthly debt payments?

- Make a note of your credit card payments and payoffs.

- What is your car payment and the loan payoff?

- Note your student loan payments and their payoffs.

- What is your current mortgage payment and the loan payoff?

- Do you have any additional consumer loan payments and payoffs?

- Write down your monthly living expenses?

- Your monthly household budget for food and supplies

- Your monthly automobile budget for gas and maintenance

- Your monthly health insurance payments

- The monthly amount going to retirement savings

- The monthly amount for entertainment

- Any additional monthly expenses

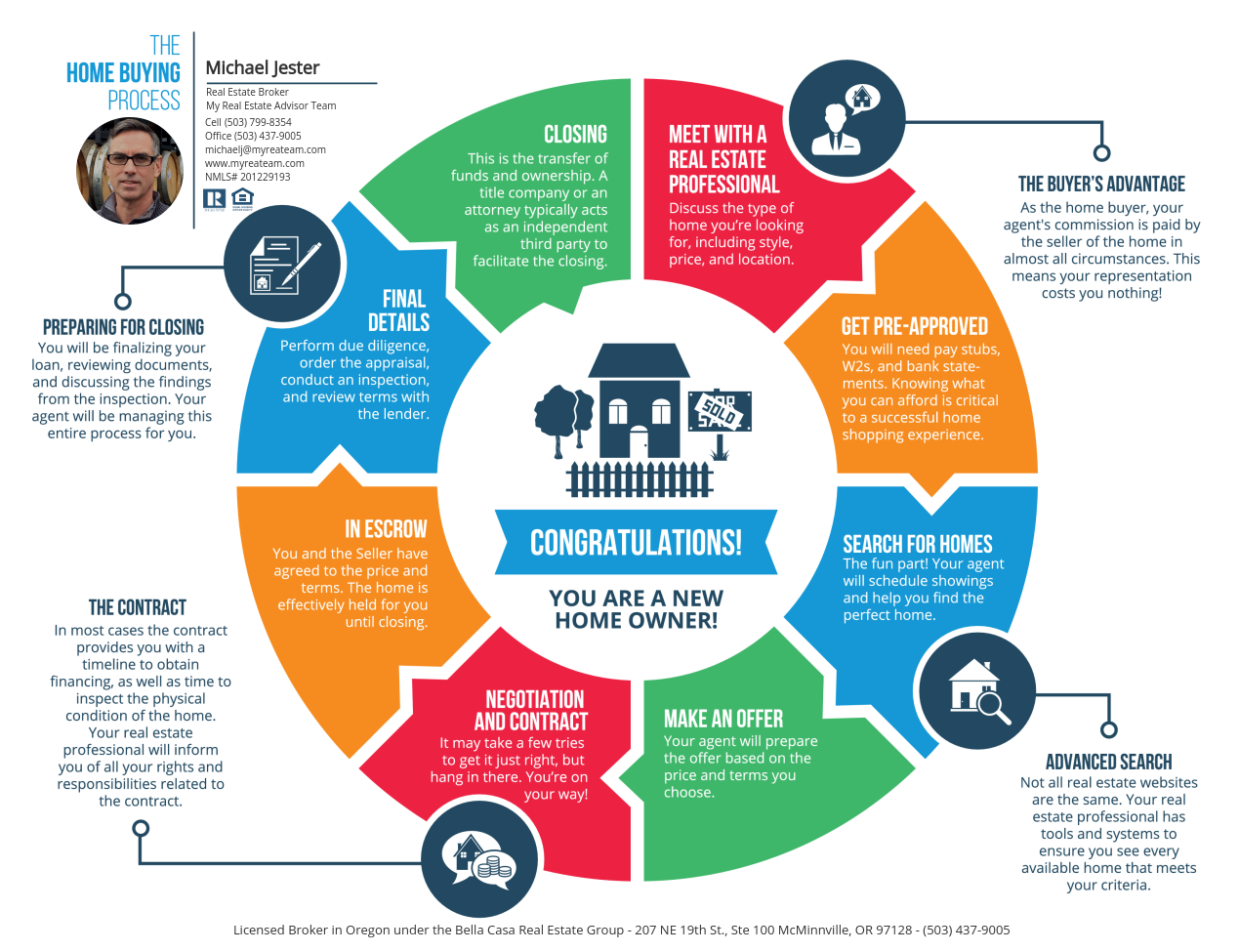

Now that you have all the paperwork pulled together and ready, The rest is a pretty simple 9-step process:

- Meet with a real estate professional

- Get pre-approved (not just pre-qualified) for a mortgage

- Search for homes in your price range and target neighborhood

- Make an offer to purchase

- Negotiate and sign a contract for the purchase

- Enter into escrow

- Order an appraisal, complete inspections, and review your loan terms

- Close the purchase, and grab your new home keys

- Move in and enjoy

It may sound overwhelming, but a simple call our office at (503) 799-8354 or email us and we will help start the conversation toward developing the plan toward homeownership. It is amazing to own your own home, and it can be a great investment if you manage it correctly.

We would enjoy the chance to be the best advisor on your real estate journey. We are here to guide you through the process and help you stay on track to your goal.