The biggest players in our real estate economy met this week to look deep into their collective wisdom to plan a course of action and give us an outlook on what the real estate market may look like in 2022.

The Fed( or the FOMC as they are formally known) met this week to give its response to the present US economy, and the National Association of REALTORs met to give its members their own projection of how the FOMC’s announcement will guide the real estate market into and through 2022.

Jerome Powell, the visible point person for Federal Reserve said that they,

“decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities.”

Federal Reserve issues FOMC statement: 15 December, 2021 @ 14:00hrs EST.

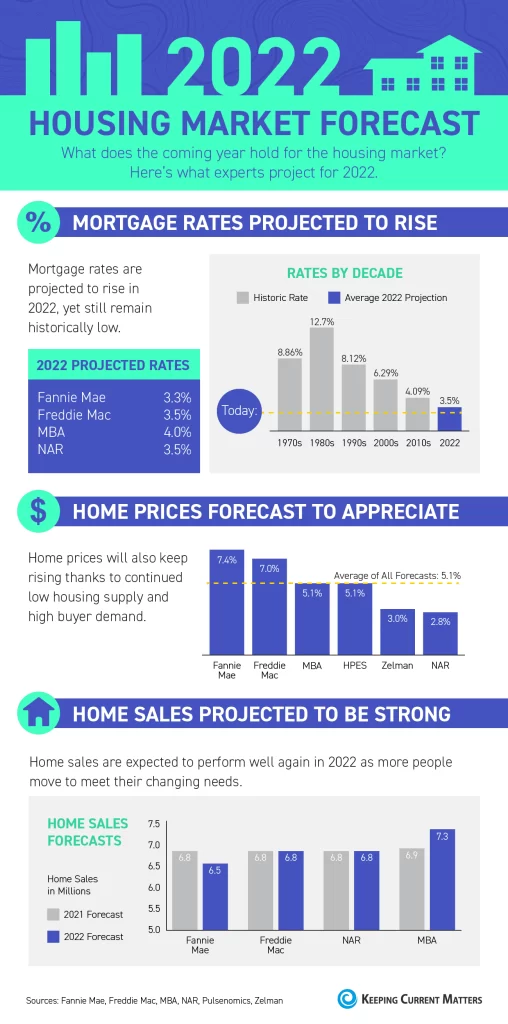

To understand why this is such a big thing, you should check out how the Federal Reserve Works, and why they exist. But the short answer as to what Jerome Powell and Fed’s statement means to the future of 2022 real estate is that buyers shopping for a mortgage loan will see higher percentage rates for those mortgages probably starting in March if not sooner.

Mr. Powell followed the announcement on Wednesday with a Q&A with notable economists and the media. In his comments with those individuals, he said the Fed may be looking at three (3) bank rate increases in 2022 for the Federal Reserve Member Banks. This means buyers with a mortgage loan will be getting approved for less principal as the interest rates increase throughout 2022.

The National Association of REALTORs (NAR), met on Thursday to discuss the future of 2022 real estate across the US and they had some mixed thoughts about the matter.

The committee at NAR is thinking the annual median home price will rise by 5.7%, much lower than the freakishly hot housing market that has seen double-digit increases from 2020 to 2021. They also think that inflation will slow its massively persistent rise that we have been seeing the last three months and may only rise about 4% for 2022; a closer-to-normal inflation percentage, but a rise nonetheless.

“Overall, survey participants believe we’ll see the housing market and broader economy normalize next year,”

Lawrence Yun, Chief Economist, National Association of REALTORS®: Experts: Housing Market Likely to ‘Normalize’ in 2022; 16 December, 2021

NAR believes, “existing-home sales will decline to 5.9 million in 2022 and housing starts will increase modestly to 1.67 million as the pandemic’s supply chain backlogs subside.”

The Bottom Line

If you have been holding off listing your home in hopes of gaining significant equity, like sellers saw this past summer and fall, this is probably coming to an end. Call us and we can help you with the right plan to get your home on the market to maximize your home’s potential. With historically low inventory (Low Supply) and a lot of buyers still looking for the perfect next place to live(Demand); you can still get good value for your money.

If you are presently looking to buy, now is a good time as more sellers will be bringing their homes to the market with stabilizing home prices. This means you will have a better chance to grab that home you are dreaming about because there will be more to look at and make an offer on without the fear of being in a bidding war.

We are here to help, just reach out and let us help you make a plan.