Some people are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. The internet is awash with articles, blog posts, and YouTube videos with titles that herald the soon to be seen doom and fall of all humanity because the stock market and housing prices are at an all-time high like (only follow the link if you want entertainment and not real facts), “The Housing Crash Coming! $9 Trillion Housing Debt Heading To Economic Collapse & Stock Market CRASH.” Some of the data is good, and others are simply fake news designed to instill fear and pull at that emotional heart-string.

The reality is there are many factors that influence all the markets in our US economy, and the housing market is only one of those markets. Unless our economy takes a huge tank, the housing market is pretty stable and only influenced by normal economic factors like supply and demand and interest rates.

A great understanding of how prices are influenced in the market is explained by Graham Stephen over at YouTube :

The people over at Investopedia have a great article on housing markets, and what influences corrections.

“The price of housing, like the price of any good or service in a free market, is driven by supply and demand. When demand increases and/or supply decreases, prices go up. In the absence of a natural disaster that decreases the supply of housing, prices rise because demand trends outpace current supply trends. Just as important is that the supply of housing is slow to react to increases in demand because it takes a long time to build a house, and in highly developed areas there simply isn’t any more land to build on. So, if there is a sudden or prolonged increase in demand, prices are sure to rise.”

https://www.investopedia.com/articles/07/housing_bubble.asp

But today, some people are instilling fear by telling us to look at the availability of mortgage money as a major influencer in the potential of a housing market correction. Now, this is true that the availability of mortgage money is important, and recent articles about the availability of low down payment loans and down payment assistance programs may be a reason for concern. They’re saying we’re returning to the bad habits of a decade ago. Let’s alleviate the fears about the current mortgage market.

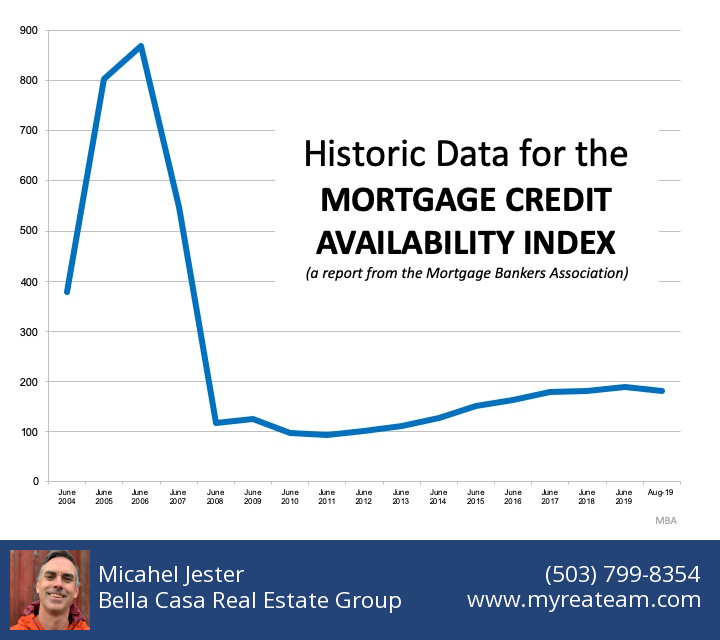

The Mortgage Bankers’ Association releases an index several times a year titled: The Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is…a summary measure which indicates the availability of mortgage credit at a point in time.”

Basically, the index determines how easy it is to get a mortgage. The higher the index, the more available the mortgage credit.

Here is a graph of the MCAI dating back to 2004, when the data first became available: As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

Thankfully, lending standards have eased since. The index, however, is still below 200, which is half of what it was before things got out of control in 2006 and 2007.

Bottom Line

It is easier to get a mortgage today than it was immediately after the market crash, but it is still difficult due to the constraints on lending and the requirements of the DTI, credit ratings buyers need to have, and the appraisal requirements for properties in order to get a loan. The difference in 2006? At that time, it was difficult not to get a mortgage.

If you have any questions or concerns about the housing market, just reach out and we can chat over a cup of coffee in person or a phone call. I’m here to give you the best information that will guide you on your real estate journey.

Cheers,

Michael Jester

Oregon Licensed Real Estate Broker

My Real Estate Advisor Team

(503) 799-8354 cell

(503) 437-9005 office

michaelj@myreateam.com

Bella Casa Real Estate Group

207 NE 19th Street, Suite 100

McMinnville, OR 97128

(503) 437-9005 office

https://thebellacasagroup.com